We’d begin to get some nice used electrical automotive offers beginning in 2026 as EV lease returns are anticipated to surge in an enormous manner.

Whereas the EV revolution has been happening for over a decade now, the used EV market remains to be fairly immature as a result of EVs have solely been delivered in massive volumes for the previous couple of years.

2026. That’s going to be the 12 months of the used EV.

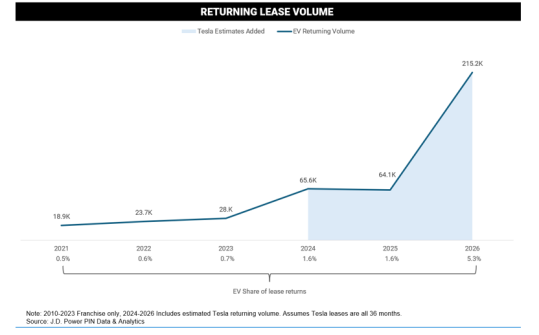

J.D. Energy is out with a brand new report that states an anticipated 230% enhance in electrical car lease return in 2026:

Lease volumes for brand spanking new EVs surged 355% all through 2023 and 88% via September 2024. Franchise-only (excluding Tesla) EV lease volumes had been even increased, rising 438% all through 2023 and 109% via September 2024. Consequently, returning EV lease volumes are projected to dip barely in 2025 earlier than spiking 230% in 2026. This development runs counter to what’s occurring industry-wide the place whole lease volumes for gas-powered automobiles have been decrease than pre-pandemic ranges, creating a possible scarcity in used-vehicle availability in 2025 and 2026.

After projections for a roughly flat 12 months in 2025, the report expects a large enhance in 2026 based mostly on present lease information:

The explanation for the surge is sort of easy. The extremely reported “lease loophole” to get entry to the tax credit score has resulted in a surge of EV leases:

Due largely to a provision within the federal Clear Automobile Tax Credit score, which permits auto sellers to go alongside a $7,500 tax credit score to all EV lessees, practically half (46%) of all franchise EV gross sales and 21% of whole EV gross sales (together with Tesla) in 2023 had been leases. That development continued all through the primary 9 months of 2024, with the lease share of whole franchise and Tesla EV quantity reaching 30%. In the meantime, lease volumes for gas-powered automobiles have been decrease than pre-pandemic ranges. Trade-wide, simply 2.4 million gas-powered automobiles had been leased in 2023. Whereas that represents a 17% enhance from 2022, it’s nonetheless significantly decrease than the pre-pandemic common of greater than three million leases yearly, which is able to possible create a scarcity in used-vehicle availability in 2025 and 2026.

Whereas a few of these leasers are going to maintain their automobiles, many are going to provide them again and improve, leading to a surge of used EVs out there on the market.

Used EV costs have already come down vastly, partly as a result of Tesla slashing costs to ensure that demand to maintain up towards its quickly rising manufacturing capability between 2020-2023.

Now, these contemporary “new” used EVs to hit the market in 2026 are possible going to place loads of stress on used EV costs.

Electrek’s Take

I’m excited for extra mature used automotive markets even when it implies that EV worth will drop in 2026.

Most individuals purchase used automobiles and up to now, they’ve been fairly restricted of their EV choices. It does sound like 2026 would be the 12 months when the used EV market will broaden into one thing extra impactful, and lower-income folks will have the ability to get off of gasoline.

It’s going to be an enormous step within the EV revolution.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.